UK Law Firm Pricing Briefing - April 2024

- James Markham

- Apr 25, 2024

- 4 min read

Updated: Apr 26, 2024

Background

The UK Office for National Statistics (ONS) produces a quarterly Services Producer Price Index (SPPI). This contains useful data on pricing of legal services and broader inflation impacting businesses.

This briefing is based upon the April 2024 release and is of relevance to law firm partners and management involved in the pricing of legal services to understand the general pricing trends for UK B2B law firms.

Annual Legal Services Price Trends

Chart 1 shows an acceleration in legal services price inflation for the year ended 31 December 2023 to 7.4%.

This is 1.9 percentage points, or a third, above the post-covid average of the 5.5% annual inflation rate.

It is an even more significant 4.5 percentage points ahead of, or more than double, the pre-covid average rate of 2.9%.

Chart 1: Legal Services prices accelerate away from the pre-Covid trend

Law firms find themselves in a materially different inflationary environment compared to five years ago, but beneath this macro-level picture not all have adapted equally. I see three broad approaches over the post-Covid period:

Slow and steady: Consistent annual increases of 5 – 6% throughout.

Late to the party: 0 – 2% increases in 2020, and possibly even 2021, playing catch up in 2022 and 2023 with +10% increases.

Wait… What party? Firms persisting with the pre-Covid trend of ~3% increases in the post-Covid world. Prices are likely 15 - 20% lower at the end of 2023, compared to the other approaches.

Wider Price Trends

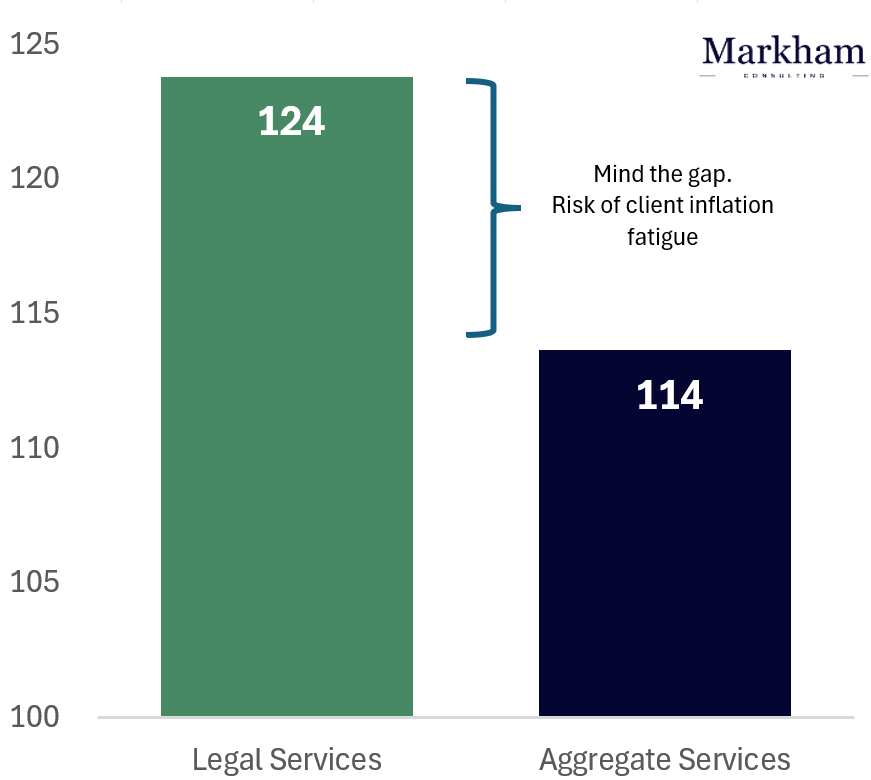

Chart 2 gives us some indication of how law firm B2B clients are experiencing inflation over the post-Covid period.

Using 2019 as a baseline (100), egal services have grown notably more expensive for B2B services clients than:

The general, non-payroll inflation they are experiencing in their business, and

The price increases they are passing through to their own customers and clients

Chart 2: Post-Covid legal price inflation is higher than aggregate services inflation

There is a risk that clients become fatigued with, yet another, price increase from their law firm that exceeds that from their other suppliers, and that they themselves are unable to pass onto their own customers.

2023 legal services prices are 24% higher than 2019, and noticeably higher than the 14% increase in general prices for B2B clients. Law firm partners and pricing professionals can generally expect client pushback on further price increases.

Pricing Outlook

Chart 3 shows the percentage change between one quarter compared to the same quarter from the prior year, for both the Legal Services (blue) and the Aggregate Services (orange) indices. Dotted lines show the moving average for the previous four quarters to identify the underlying trend in the data.

Whilst the Aggregate Services Index (orange) appear to show a clear downward trend towards 3 – 4%, the Legal Services Index (blue) is less clear with a sharp spike in 2023 Q3 muddying the waters.

Chart 3: Aggregate services inflation is cooling, but the outlook for legal services is less clear

If we assume 2023 Q3 is anomalous, then the Index may start to trend in a range of 5 – 6% in the coming quarters; noticeably higher than the Aggregate Services index, but a drop from the 7.4% recorded for the full 2023 year. It will be worth keeping an eye on this trend in the next two quarterly releases.

Next Steps

With a general disclaimer that your mileage may vary...

Revised standard rates for UK law firms are likely agreed internally for the 2023/24 financial year, and so focus for client relationship partners and pricing professionals will be on the tactics of agreeing these with existing clients in the coming months:

Socialise revised headline rates and pricing cards internally, along with the rationale for any increase.

Identify key client accounts and agree a strategy on how best to approach pricing discussions.

Proactively manage the churn in clients – which accounts no longer fit with your firm’s current pricing strategy? And which new clients will you be looking to poach from competitor firms?

Don’t forget to review fixed fee schedules for common matter types within your practice. These can slip under the radar when all eyes are on standard hourly rates.

Whilst justifying rate increases with reference to law firms’ own underlying cost pressure is understandable, clients have heard the story several times now and have an increasingly well-rehearsed pushback, especially against increases exceeding ~4%.

Better traction is likely to be gained through emphasising the value of the service to the client, along with the distinguishing characteristics of the firm; such as deep knowledge of the client or industry, that make your firm a better bet than any other.

Get in touch via the contact form below if you'd like to understand these pricing trends in the context of your own law firm or practice.

Methodology

Legal Services Price inflation data is taken from Table 3(g) of the latest Services Producer Price Index (SPPI) for Legal Services. The Aggregate Services data is taken from Table 1.

The underlying methodology is described in the ONS User Guidance and Methodology.

In summary, it’s comprised of ~500 prices drawn from a stratified random sample from the Inter-Departmental Business Register. This represents law firm submissions of realised rates on actual hours worked, weighted for the seniority of fee earner delivering the service.

The majority (>60%) of legal services in the dataset are classified as Business and Commercial.

This dataset is relevant to B2B legal services providers, but less so for (a) B2C providers and (b) providers to small businesses below VAT and PAYE registration thresholds, as these groups are not represented in the dataset.